India is facing one after another banking crisis, the major reason, we all know is bad loans and above that frauds, by bank management, as we have seen in past cases including the recent Yes Bank crisis. In light of this event, we will discuss banking failure in a comprehensive manner in this article.

What is a Bank failure?

According to Investopedia -A bank failure is the closing of an insolvent bank by a federal or state regulator. The comptroller of the currency has the power to close national banks; banking commissioners in the respective states close state-chartered banks. Banks close when they are unable to meet their obligations to depositors and others. The most common cause of bank failure occurs when the value of the bank’s assets falls to below the market value of the bank’s liabilities, which are the bank’s obligations to creditors and depositors. This might happen because the bank loses too much on its investments. It’s not always possible to predict when a bank will fail. When a bank fails, it may try to borrow money from other solvent banks in order to pay its depositors. If the failing bank cannot pay its depositors, a bank panic might ensue in which depositors run on the bank in an attempt to get their money back. This can make the situation worse for the failing bank, by shrinking its liquid assets as depositors withdraw cash from the bank.

Bank failures in India and the reasons

Live mint published a banking failure history, according to which

Bank failures have been an integral part of Indian financial history. It is not for nothing that in 1913, John Maynard Keynes after surveying the state of banking in the country, wrote in Indian Currency and Finance, “In a country so dangerous for banking as India, it should be conducted on the safest possible principles”. His warnings have proven prophetic. In fact, scams in Indian banking far predate Keynes’s warnings. It started with failure of the Presidency Bank of Bombay (PBB). The bank was started by the East India Company in 1840. It was stable and till the mid1860s. This was the period when the British started relying extensively on Bombay cotton markets, as supplies from the US had declined due to the civil war. Thus, a lot of banks began mushrooming in Bombay to fulfill the demand for capital.

It is in this environment that PBB began to issue loans recklessly against shares of private companies and even on just personal security. Then, as the civil war ended, the euphoria in the Indian cotton market turned to panic. The hitherto stable bank came to a swift close. A new Bank of Bombay was established immediately in 1868—financial institutions were, of course, central to the colonial project.

Also Read:YES Bank Crisis : RBI caps withdrawals from YES Bank

Even before the PBB, there were several bank failures in Calcutta. Several banking organizations mushroomed in the early 18th century, as economic activity centered in Calcutta. However, again, the same problems surfaced—overextended balance sheets, accounting fraud, etc.

By 1913, there were 451 banking companies. Following runs, prominent banks such as Indian Specie Bank and People’s Bank of India collapsed. The case of Indian Specie Bank is interesting—it had forwarded large loans to a prominent pearl merchant. When the merchant’s business collapsed, so did the bank. In December 1913 one newspaper, The Colonist, said that if the bank’s management had released balance sheets, the fraud could have been detected well in advance of the collapse, which is similar to the yes bank crisis of the current day.

For a long time, these failures were blamed on the absence of a central bank. Nearly 350 banks all over India closed between 1913 and 1934. In 1934 India finally RBI. Sure this central bank could now stem the rot in Indian banking?

Between 1935 and 1947, nearly 900 banks failed followed by 665 banks in the period from 1947 to nationalization in 1969. Even after the inception of RBI, there was a feeling that the RBI Act did not give enough power to regulate the sector. It was felt that additional separate legislation was needed. This feeling was strengthened following the failure of Travancore and Quilon Bank in 1938. It was only much later, in 1949, that the Banking Regulation Act was enacted which gave RBI additional regulatory powers. SLR was introduced to build reserves for safety. More importantly, both new and old banks were required to apply to RBI for a banking license. Old banks that could not fulfill new conditions were asked to merge or liquidate their operations. However licensing was a double-edged sword, as RBI could not use it aggressively to clean the system. After all, banks are deeply interconnected. You cannot restructure one without unsettling others down the line.

As always it would take yet another major collapse to expedite regulation. And that happened when Palai Central Bank failed in August 1960. RBI hit the panic button, and large-scale closures were enforced. That failure led to the formulation of deposit insurance rules in 1962, thus enhancing stability in the banking system.

In 1951, there were 566 banks of which 474 banks were unfit to be included in RBI’s Second Schedule. In 1967, this figure was pared down to 91 banks of which just 20 banks were unfit. These statistics are staggering but is perhaps still inadequate to fully convey the challenges faced by India’s banking system till 1969

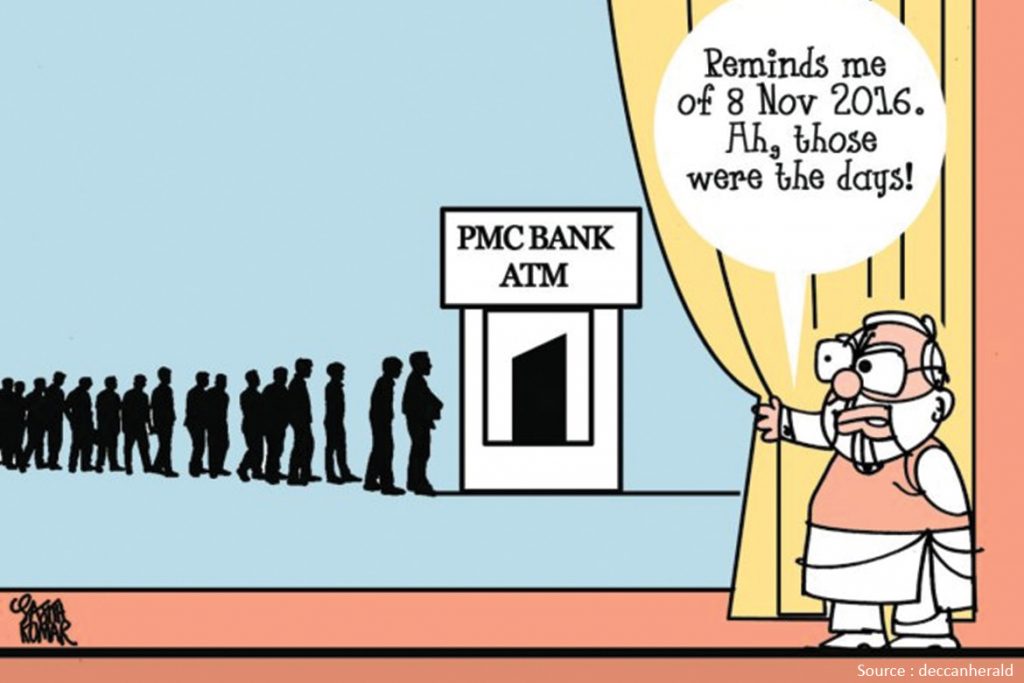

Thus the last century and a half of Indian banking has not been without its fair share of crises and controversy. RBI has tried to respond to all these crises by tightening and adding more regulations. Regardless, but to a much smaller degree, banking failures continued in some form or the other. There were stock market scams in 1992 and 2001, but arising out of fraudulent banking. Then there was the Indian Bank scam in 1996. Within the newly licensed banks of 1990s, Global Trust Bank played a major role in the 2001 stock market scam. GTB was involved in the stock market scam of 2001, that the stockbroker Ketan Parekh ran. GTB lent heavily to individuals speculating in the stock market; when the market crashed the bank suffered extensive losses. One consequence was that merger talks with UTI Bank fell through, But later it was merged into Oriental Bank. If we look past 5 years, India has seen many Public Sector bank mergers, and big frauds in banks like Punjab National Bank and PMC bank due to which bank run like situation had emerged. While there is no panic run on banks or debilitating loss of confidence in the system, the government should be worried about the increasing vulnerability and unavailability of key players in the financial system. Consider these facts: in the past one-and-a-half years, two banks and a nonbank lender have failed and had to be placed under the RBI moratorium. While Yes Bank is in the process of being rescued, a solution to revive PMC Bank is not yet in place. Last year, DHFL became the first major non-bank lender to be placed under moratorium and is now in the process of being sold. Yes, Bank is another classic example of delayed action. It was clear from last year that the bank is going to struggle to raise money.

What about People’s Money in such situation?

In India, Deposit Insurance and Credit Guarantee Corporation was established for the purpose of providing insurance of deposits and guaranteeing of credit facilities. DICGC insures all bank deposits, such as saving, fixed, current, recurring deposit for up to the limit INR 5 lakh ( this limit is recently changed in Budget, earlier it was 1 lakh only) of each deposit in a bank. India is among the countries that offer the lowest protection to depositors in cases of bank failure. Here, depositor insurance covers only INR 5 lakh per bank account, which is far below that of developed countries and even of the nations at the same stage of development as India. Though India’s deposit insurance scheme covers as many as 70 percents of bank depositors, there is a sizeable catch that accounts that have less than INR 5 lakh together make up a small number of accounts. A good thing, however, must be taken note of, which India can boast of that others can’t that, there is a significant difference between India and other markets when it comes to banking. In India, no scheduled commercial bank has been allowed to sink since liberalization. RBI and the government have always made sure that a drowning bank gets acquired before it fails. Only cooperative banks have failed here. As per figures from the Deposit Insurance and Credit Guarantee Corporation (DICGC), the cases of about 350 such banks have been settled so far for a payout of INR 4,822 crore in claims.

So looking at the track record it can be said that people must not get panic, as these days it is unlikely to happen that a bank collapse completely, but at the same time government and the central Bank should take some robust action to avoid such situations and maintain people’s trust in the banking system.