Personal loan is considered to be the best financial tool when you need money in exigencies. If you are using a credit card and pay EMI on time, which creates good credit score, then banks also give you the option of pre-approved loan. When you take a personal loan, you mainly talk about interest rate, processing fees and other charges. Fore-closure and pre-payment are two important points for personal loans, about which borrowers do not discuss much. However, it is important to know about it. In this article, we try to learn about the closure of loan and its impact on your credit score.

Regular closure

Personal loans are closed in three ways. The first mean is regular closure. In this, the customer pays EMI every month. After a certain limit, when your payment is made, your EMI is closed. In this, give the last instalment of the loan and contact the bank on the loan closure.

Pre-closure

The second option is the pre-closure. It is the process when a person repays a loan before the loan period ends. Some banks charge on the pre-closure of the loan. However, at times pre-closure helps in reducing personal rates and debt burden. Banks have different lock-in periods before which one can close a loan.

Also read: People Usually Are Unaware Of These Charges On Credit Card; Know Before Using One

However, banks charge a pre-closure fee to cover the loss on the interest amount. Different banks have different rules regarding this. In this case, you must talk to your bank or the customer care for specific information in this regard. At present, many banks do not charge any charges for pre-closure.

Partial payment

The third option is a partial payment. If you want the loan to be repaid at the earliest, then partial payment of principal amount can be made in between. There are two benefits after making a partial payment, your EMI will be decreased or the loan period will decrease. You can choose either of these options. Besides, you can make these partial payments several times in between your loan tenure.

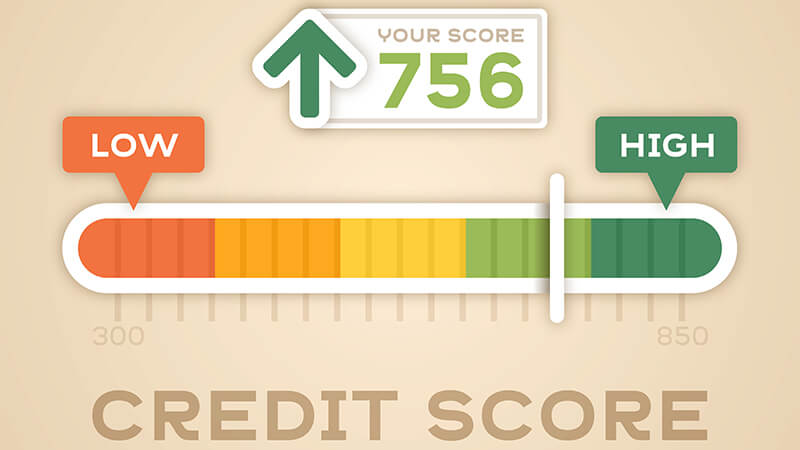

Impact on credit score

Customers should also keep in mind that if the bank charges on a partial payment or pre-closure, then the net profit in the interest is much higher than that charge. Although financial experts say that pre-payment does not show immediate effect, but in the long run it has a negative effect on credit score. In this case, this option can be selected if your credit score is already very good. If your credit score is improving then pre-closure should be avoided in that condition.