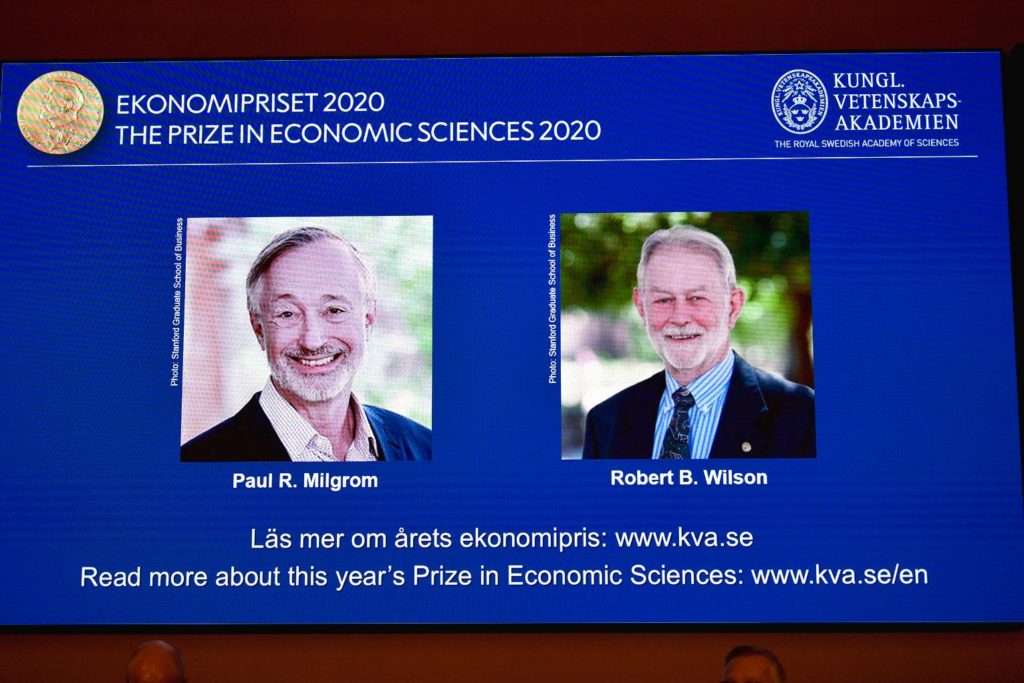

This year the Nobel Prize in Economics has been given to Paul R. Milgrom and Robert B. Wilson. The Nobel Prize Committee on Monday announced the sixth and final award winners of this year. With this, the week-long process of award-giving comes to an end.

The Nobel Prize in Economics is known as the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. But it is now widely known as Nobel Prize in Economics. This award was established in 1969 and this was 51st prize since then.

Milgrom and Wilson have been awarded this award for “improvements to auction theory and inventions of new auction formats.” Paul R. Milgrom and Robert B. Wilson both work at Stanford University in the United States. They studied how the auction process works. They created new auction formats for goods and services that are difficult to sell traditionally. Their invention has benefited sellers, buyers and taxpayers around the world.

Also read: Nobel Prize In Chemistry 2020: Two Women Scientists Share The Prize This Year

What is the auction principle?

Using the auction principle or auction theory, researchers try to understand the results of various rules for bidding and final prices. This analysis is difficult because bidders conduct strategic behaviour based on available information. They keep both sides in mind what they know and what the other bidders know according to them.

Wilson developed the theory for the auction of a common value item. Accordingly, a value that is already uncertain but at the end remains the same for all. Wilson showed through his theory why rational bidders place bids below their best estimate of their normal value. They are concerned about the loss of being the winner. In other words, they are worried about overpaying and the loss due to it.

Also read: Nobel Prize In Physics 2020: Rogan Penrose, Reinhard And Andrea Share This Year’s Prize

Milgrom formulated a general principle of an auction that not only allowed normal values but also personal estimated values. This personal value bid varies for each bidder. He analysed bidding strategies in several well-known auction formats. He found that when people get more information about each other’s estimated value while bidding, a format gives the seller higher expected revenue.